LG Chem Announces Q3 Financial Results

2024.10.29■ Q3 Consolidated Performance (Including LG Energy Solution)

□ Revenue: KRW 12.6704 trillion (6.1% decrease YoY)

□ Operating Profit: KRW 498.4 billion (42.1% decrease YoY)

■ CFO Dong Seok Cha

“Despite a modest improvement in revenue and profitability supported by strong performances from our subsidiary LG Energy Solution and Advanced Materials, concerns over the challenging business environment will likely persist in the near term.

“We are fully committed to enhancing operational efficiency and preparing growth-driven businesses to secure future growth opportunities.”

LG Chem released its third-quarter financial results on the 28th, reporting consolidated revenue of KRW 12.6704 trillion and an operating profit of KRW 498.4 billion.

Compared to the same period last year, revenue decreased by 6.1% and operating profit by 42.1%. However, compared to the previous quarter, revenue increased by 3.0% and operating profit by 22.8%.

CFO Dong Seok Cha commented, “Despite a modest improvement in revenue and profitability due to robust performances by Advanced Materials and our subsidiary LG Energy Solution, concerns over the challenging business environment are expected to remain for some time, adding that, “We will continue to focus on enhancing efficiency and preparing growth-driven businesses to capture future growth opportunities."

Detailed Q3 Performance and Q4 Outlook by Business Division:

The Petrochemicals Company posted a revenue of KRW 4.8132 trillion and an operating loss of KRW 38.2 billion. This temporary deficit was driven by increased raw material prices, freight costs, and a decline in foreign exchange rates.

In Q4, the company anticipates improved profitability due to cost benefits from falling raw material prices, higher utilization rates at new plants, and increased sales across North America and Europe.

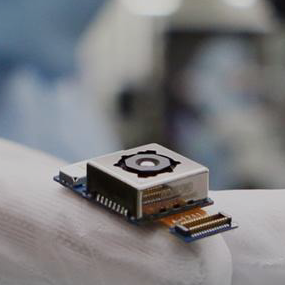

The Advanced Materials Company recorded a revenue of KRW 1.7124 trillion and an operating profit of KRW 150.2 billion. Battery materials faced minor declines in shipments and sales prices, impacted by exchange rate fluctuations.

In Q4, limited growth in revenue and profitability is expected due to year-end inventory adjustments by clients and the seasonal off-peak period for electronic materials.

The Life Sciences Company reported a revenue of KRW 307.1 billion and an operating loss of KRW 0.9 billion. Strong shipments of key products, including diabetes treatments and vaccines, were offset by increased R&D expenses, leading to a slight deficit.

In Q4, steady growth in key products is anticipated; however, profitability may decline due to continued R&D costs for advancing global clinical projects.

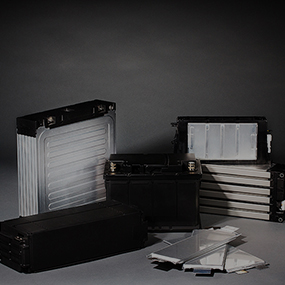

The subsidiary LG Energy Solution posted a revenue of KRW 6.8778 trillion and an operating profit of KRW 448.3 billion. Increased demand from European customers and expanded production in North America contributed to revenue growth, while higher utilization rates and stable metal prices boosted profitability.

In Q4, despite expected impacts from client inventory adjustments and metal price declines, growth in battery supplies for electric vehicles and energy storage systems (ESS) is forecasted.

The subsidiary Farm Hannong recorded a revenue of KRW 112.8 billion and an operating loss of KRW 19.6 billion. Although domestic sales of crop protection agents increased slightly, the company recorded a loss due to the discontinuation of its low-margin fertilizer chemical business.

In Q4, the company plans to continue its efforts to expand both domestic and international sales of crop protection agents and improve its profit structure.