LG Display Reports Third Quarter 2024 Results

2024.10.24SEOUL, Korea (Oct. 23, 2024) – LG Display today reported unaudited earnings results based on consolidated K-IFRS (International Financial Reporting Standards) for the three-month period ending September 30, 2024.

- Revenues in the third quarter of 2024 increased by 2% to KRW 6,821 billion from KRW 6,708 billion in the second quarter of 2024 and rose by 43% from KRW 4,785 billion in the third quarter of 2023.

- Operating loss in the third quarter of 2024 was KRW 81 billion. This compares with the operating loss of KRW 94 billion in the second quarter of 2024 and with the operating loss of KRW 662 billion in the third quarter of 2023.

- EBITDA profit in the third quarter of 2024 was KRW 1,162 billion, compared with EBITDA profit of KRW 1,287 billion in the second quarter of 2024 and with EBITDA profit of KRW 382 billion in the third quarter of 2023.

- Net loss in the third quarter of 2024 was KRW 338 billion, compared with the net loss of KRW 471 billion in the second quarter of 2024 and with the net loss of KRW 775 billion in the third quarter of 2023.

LG Display recorded KRW 6.821 trillion in revenues and KRW 81 billion in operating loss in the third quarter of 2024.

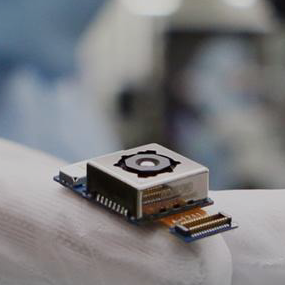

Revenues increased 2% quarter-on-quarter and 43% year-on-year, as the company’s small-sized panel shipments grew, including panels for mobile devices. In particular, the proportion of OLED products rose by 16%p year-on-year to make up 58% of revenues as LG Display continually pursued an advanced business structure centered around its OLED business.

Profitability continued to improve quarter-on-quarter and year-on-year thanks to the expanded achievement of the company’s advanced business structure and its focus on enterprise-wide cost innovation along with operational efficiency activities, although there was some impact from one-off costs due to its efforts to improve manpower management efficiency.

Panels for TVs accounted for 23% of revenues in the third quarter. Panels for IT devices, including monitors, laptops, and tablet PCs, accounted for 33%, panels for mobiles and other devices accounted for 36%, and panels for automobiles accounted for 8%.

LG Display plans to continue to expand its management performance by improving its structure through the advancement of its OLED-oriented business and focusing its capabilities on improving profitability based on operational efficiency and cost innovation activities.

In its small- and mid-sized OLED business, the company plans to solidify its competitiveness based on stable supply capabilities and technological leadership. It will seek revenue growth and secure profitability for OLED for mobile devices through rising shipments and product diversification by actively utilizing its enhanced production capacity and capabilities. Regarding OLED for IT products, the company is committed to strengthening its leadership in Tandem OLED, which features excellent durability and performance including long life, high luminance, and low power consumption. Also, it will establish an efficient response system such as ways to maximize production infrastructure in line with the changing market environment.

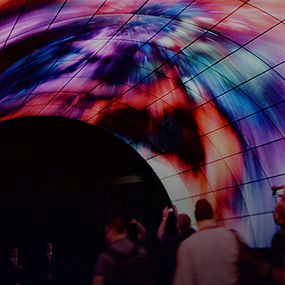

Regarding its large-sized OLED business, LG Display is aiming to pursue qualitative growth by improving profitability. Based on close collaboration with customers, the company will further expand its lineup of differentiated and high-end products that reflect consumer needs. These include not only ultra-large and ultra-high-definition displays but also human-friendly products that offer health benefits to users as well as gaming monitors. It will also seek innovation in its operating structure, including efficient production and sales strategies as well as cost reduction linked to actual demand.

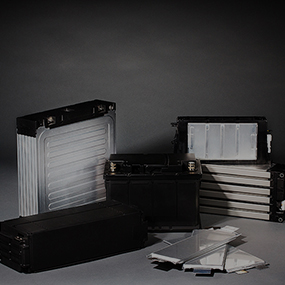

As for its automotive display business, LG Display will continue to pursue orders related to all vehicles, such as internal combustion and electric vehicles, through its differentiated products and technology portfolio comprising P-OLED based on Tandem technology, Advanced Thin OLED (ATO), and high-end LTPS LCD. It plans to build a stable profit structure by continuously expanding its customer base, increasing its proportion of OLED products, and enhancing cost competitiveness.

"We are continually improving our performance by focusing our enterprise-wide capabilities on the advancement of our business structure, cost structure improvement, and cost innovation activities," said Sung-hyun Kim, CFO and Executive Vice President of LG Display. Kim added, "Although we expect ongoing uncertainty in the market and external environment as well as volatility in actual demand, we will continue to improve our performance gradually by focusing on profitability based on the expansion of our business structure advancement and operational efficiency."