LG Chem Announces Q2 Financial Results

2025.08.12■ Q2 Consolidated Performance (Including LG Energy Solution)

□ Revenue: KRW 11.4177 trillion (6.7% decrease YoY)

□ Operating Profit: KRW 476.8 billion (21.5% increase YoY)

■ CFO Dong Seok Cha:

“During the second quarter, the operating environment remained challenging due to soft global demand caused by the U.S. tariff dispute and geopolitical instability in the Middle East, as well as the conservative inventory management of customers ahead of the early expiration of electric-vehicle subsidies.”

“Looking ahead, we will strive to maintain solid mid- to long-term growth by executing pre-emptive business and asset optimization, accelerating portfolio restructuring toward high-growth, high-margin businesses, achieving meaningful volume growth through customer diversification in the Advanced Materials Company, and securing future demand with our differentiated technologies.”

LG Chem announced on the 7th that it recorded consolidated revenue of KRW 11.4177 trillion and operating profit of KRW 476.8 billion for the second quarter of this year.

Revenue declined 6.7% year-on-year, while operating profit increased 21.5%. Compared with the previous quarter, revenue fell 5.8%, whereas operating profit rose 8.9%.

CFO Dong Seok Cha remarked, “The second quarter remained challenging due to subdued global demand caused by the U.S. tariff dispute and geopolitical instability in the Middle East, as well as conservative inventory policies among customers ahead of the early termination of EV subsidies,” adding, “We will sustain solid mid- to long-term growth by carrying out pre-emptive business and asset optimization, reshaping our portfolio around high-growth, high-profit businesses, securing meaningful volume growth through customer diversification in the Advanced Materials Company, and capturing future demand with our differentiated technologies.”

Reviewing Detailed Q2 Performance and Q3 Outlook by Business Division:

The Petrochemicals Company recorded revenue of KRW 4.6962 trillion and an operating loss of KRW 90.4 billion. The loss persisted due to continued buying hesitation stemming from the U.S. tariff dispute and instability in the Middle East, coupled with unfavorable foreign-exchange effects. In the third quarter, the Company aims to improve profitability through the normalization of new capacity additions for key products in North America and Asia and ongoing cost-reduction initiatives.

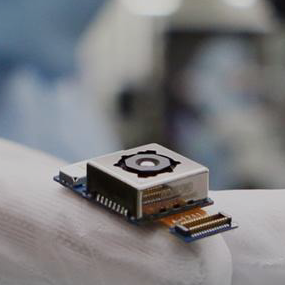

The Advanced Materials Company posted revenue of KRW 1.0605 trillion and an operating profit of KRW 70.9 billion. Shipments of battery materials declined as purchasing sentiment weakened under policy uncertainty, yet sales of high-value-added products in electronic and engineering materials remained solid. In the third quarter, demand for EV battery materials is expected to soften as major automakers and battery customers maintain conservative inventories following the early termination of IRA subsidies.

The Life Sciences Company generated revenue of KRW 337.1 billion and an operating profit of KRW 24.6 billion. Sales of core products, including vaccines, oncology medicines, and autoimmune-disease treatments, remained robust. In the third quarter, both revenue and operating profit are projected to rise with the receipt of the remaining upfront payment from the licensing-out of a rare-obesity treatment.

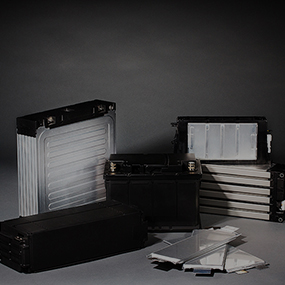

The subsidiary LG Energy Solution reported revenue of KRW 5.5654 trillion and an operating profit of KRW 492.2 billion. Although revenue fell because customers maintained conservative inventory policies, operating profit remained positive even before U.S. production incentives, supported by an improved product mix from a higher share of North-American output and company-wide cost-saving efforts.

In the third quarter, North-American customers are expected to continue conservative inventory management amid policy changes, yet shipments of cylindrical cells should increase, and large grid projects are set to drive a full-scale ramp-up of ESS battery production in the region.

The subsidiary Farm Hannong recorded revenue of KRW 242.4 billion and an operating profit of KRW 12.5 billion. Sales of key products such as crop-protection agents and seeds were steady, but higher raw-material costs reduced profitability year-on-year. In the second half, revenue is likely to decline due to seasonal factors, yet profitability is expected to improve versus the prior year on the back of expanded sales of crop-protection products.